Do good. Be kind. Build value.

We go above and beyond to help you do the unexpected.

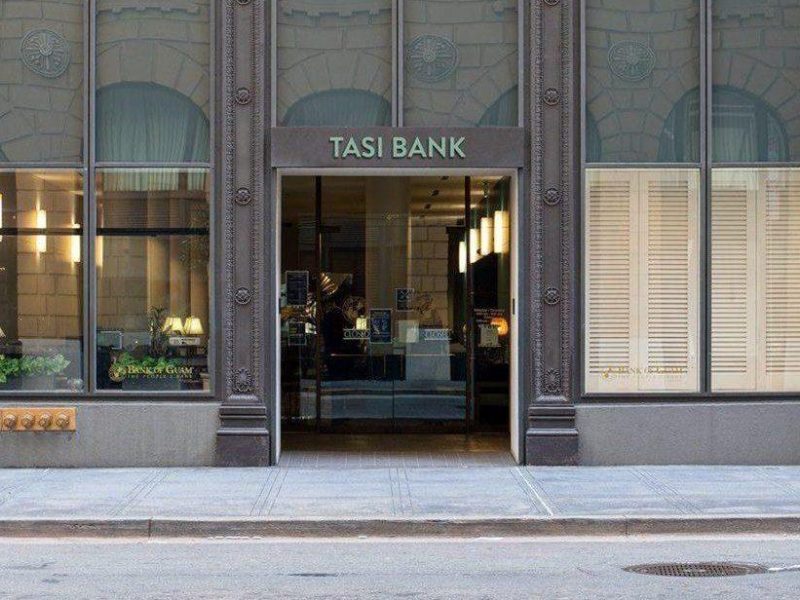

We are TASI® Bank, a division of the Bank of Guam® and rebels in the way we approach modern-day banking. We are proud to be a Minority Depository Institution (MDI), working with small business owners throughout the West Coast who empower their communities through big ideas and bigger initiatives.

Our Mission

TASI® Bank is the Maverick of community banking, challenging the market for the good of our clients. We have the courage to take risks and are the approachable experts in small business banking and commercial lending.

We build value by providing our clients and prospects the best banking services in the region. As Mavericks, we love challenging the rules. Especially when they’re confining, confusing, outdated, or ineffective. We are convicted by our vision and ideas.

We bring a fresh, client-focused approach to small business and commercial lending. From product design through application, to how we make decisions and disburse, our clients’ needs always lead the way.