10.16.25 - Riding the Wave: What the Current Interest-Rate Climate Means for Your Business

10.16.2025

Part 1 of 3 in the “Navigating the Rate Wave” series

By Alan Gaul, VP., Marketing & Brand, TASI Bank.

If 2024 felt like paddling through choppy economic waters, 2025 has been the year of unpredictable swells. Inflation is cooling, the Fed is cautious, and business owners are still trying to read the tide chart. Rates haven’t crashed, but they’ve certainly crested — and that makes this the moment to check your footing before the next set rolls in.

At TASI Bank, we call that Maverick thinking: stay alert, stay balanced, and always know where your board is pointed.

The State of the Current Wave

After more than a year of rate hikes, the Fed has paused — but not yet pivoted. Borrowing costs remain elevated, and commercial clients across every sector are feeling it: higher debt service, tighter margins, and a new discipline around cash management.

For many, this has been the first sustained period of “higher for longer” financing costs in a decade. The smart move now isn’t panic; it’s perspective.

What It Means for Your Business

- Variable rates bite first.

If your loan is indexed to Prime, SOFR, or another floating benchmark, those monthly payments have crept upward. Review them closely. - Liquidity is leverage.

Cash cushions aren’t just comfort — they’re confidence. Businesses with accessible liquidity are better positioned to absorb rate shocks or seize new opportunities. - Credit discipline matters.

Renewals, covenants, and maturities all look different in a high-rate environment. Know your terms before they surprise you.

The Maverick Mindset

In surfing — and in banking — you can’t stop the wave, but you can decide how to ride it. Rates are a natural rhythm of the market. Understanding their motion helps you plan expansion, manage working capital, and protect profit margins.

Our best advice? Don’t chase the forecast; build a strategy flexible enough to handle whichever direction the next swell comes from.

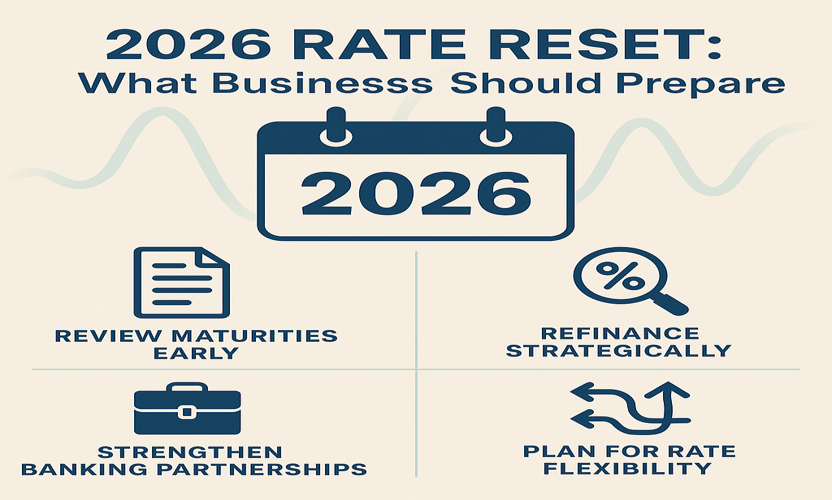

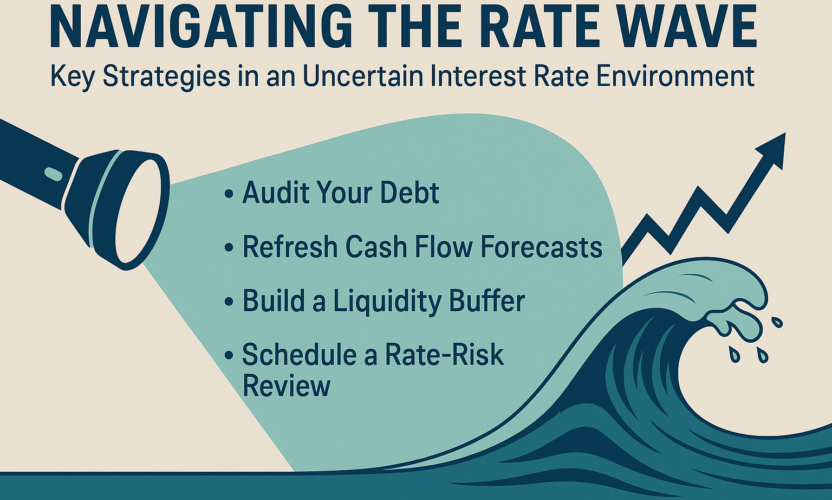

Actionable Takeaways

- Audit your debt.

List every loan, note which ones are fixed and which float. Ask yourself what would happen if rates moved 1% either way. - Refresh your cash-flow forecast.

Model at least two scenarios — current rates and +1% — for the next 12 months. - Schedule a rate-risk review.

A 30-minute conversation with your banker can uncover ways to restructure or hedge exposure. - Build your liquidity buffer.

Aim for 2–3 months of operating expenses in reserve. If that feels out of reach, start with one month and grow from there. - Think like a strategist, not a surfer.

The goal isn’t to avoid waves; it’s to move with them intentionally.

The TASI Takeaway

Uncertainty doesn’t have to mean instability. Whether you’re managing a hotel, running a family-owned business, or financing new equipment, proactive planning today positions you for tomorrow’s calm.

Rates are unpredictable — your strategy doesn’t have to be.

Let’s chart your course together.

Coming Next Week:

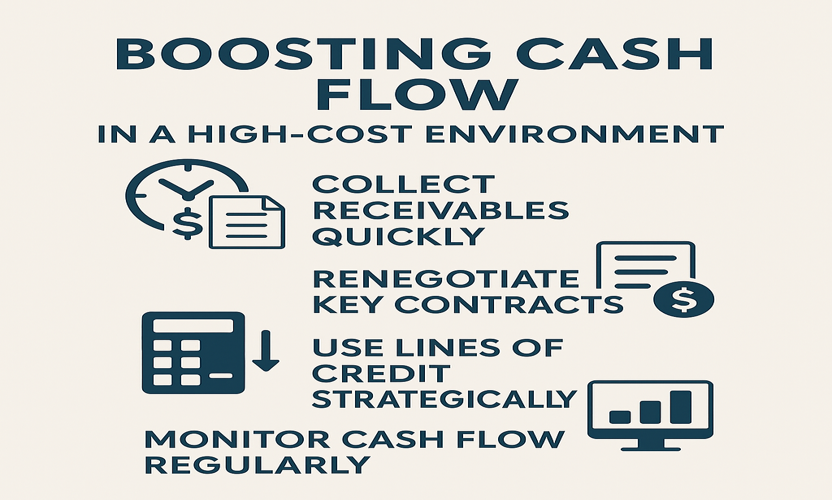

“Holding the Line: Practical Cash-Flow Strategies in a High-Cost Environment” — Part 2 of our three-part series on Navigating the Rate Wave.