10.22.25 - Holding the Line: Practical Cash-Flow Strategies in a High-Cost Environment

10.22.2025

Part 2 of 3 in the “Navigating the Rate Wave” series

By Alan Gaul, VP., Marketing & Brand, TASI Bank

If Part 1 was about understanding the wave, Part 2 is about balancing on it.

Because in 2026, cash flow isn’t just a metric — it’s a survival skill.

With operating costs staying high and margins squeezed, this is the time to make every dollar work harder and stay in the current longer. The good news: there are proven, Maverick-tested ways to do just that.

1. Tighten the Timing

Cash flow is a rhythm game.

- Invoice fast, collect faster. If your payment terms are net-30, aim to send invoices within 24 hours of delivery.

- Reward speed. Offer small early-pay discounts or electronic payment options.

- Nudge with grace. Automate gentle reminder emails — not guilt trips — to keep receivables from drifting out to sea.

A ten-day improvement in collections can free up thousands in working capital without borrowing a dime.

2. Rethink Recurring Expenses

Go line by line through your monthly spend and ask one Maverick question:

“Is this cost creating momentum, or just keeping me afloat?”

- Renegotiate leases and vendor terms — many suppliers will trade flexibility for loyalty.

- Audit software subscriptions, utilities, and maintenance contracts.

- Shift fixed costs to variable where possible (e.g., cloud storage, seasonal labor).

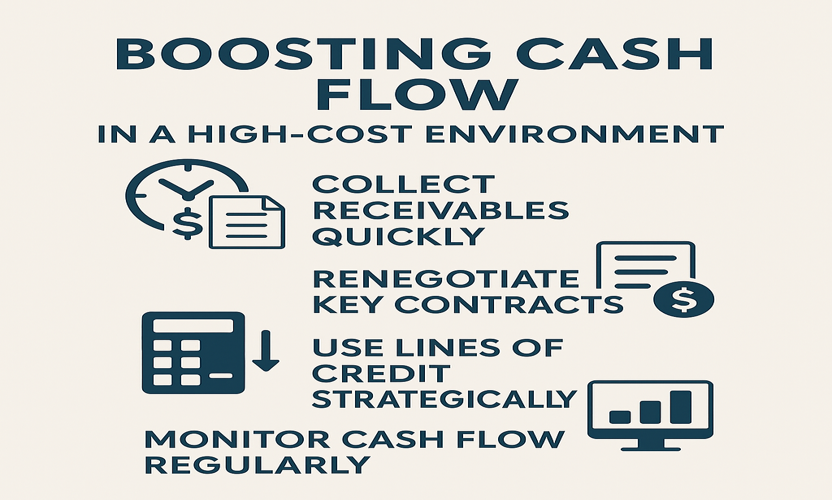

3. Use the Right Tools for the Tide

Sometimes, the right financing tool turns choppy waters into manageable waves.

- Lines of Credit: Use strategically, not habitually. Great for inventory or short-term working-capital needs.

- Interest-Only Periods: Ask if temporary interest-only payments make sense while cash flow stabilizes.

- Equipment Loans or SBA Programs: Leverage lower rates for productivity investments that pay off long-term.

The Maverick rule: debt should generate efficiency, not anxiety.

4. Real-World Ripple

A Northern California distributor recently trimmed 18 days off receivables by automating invoicing and adjusting vendor pay cycles. The result: $120 K in freed-up cash flow — enough to cover payroll through a slower season without tapping credit lines.

Small moves. Big stability.

Actionable Takeaways

- Shorten receivable cycles by at least 10 days.

- Review vendor contracts and renegotiate 1–2 key agreements this quarter.

- Evaluate credit-line renewals before year-end to lock current terms.

- Automate cash-flow dashboards for weekly visibility.

- Track cash as a strategic metric, not just a report line.

The TASI Takeaway

Tight cash flow doesn’t have to mean tight breathing.

When you plan, measure, and act deliberately, you create financial flexibility — and confidence — even in higher-cost waters.

When margins tighten, precision wins.

Coming Next Week:

“Looking Ahead: Positioning Your Business for the 2026 Rate Reset” — the final post in the Navigating the Rate Wave series.