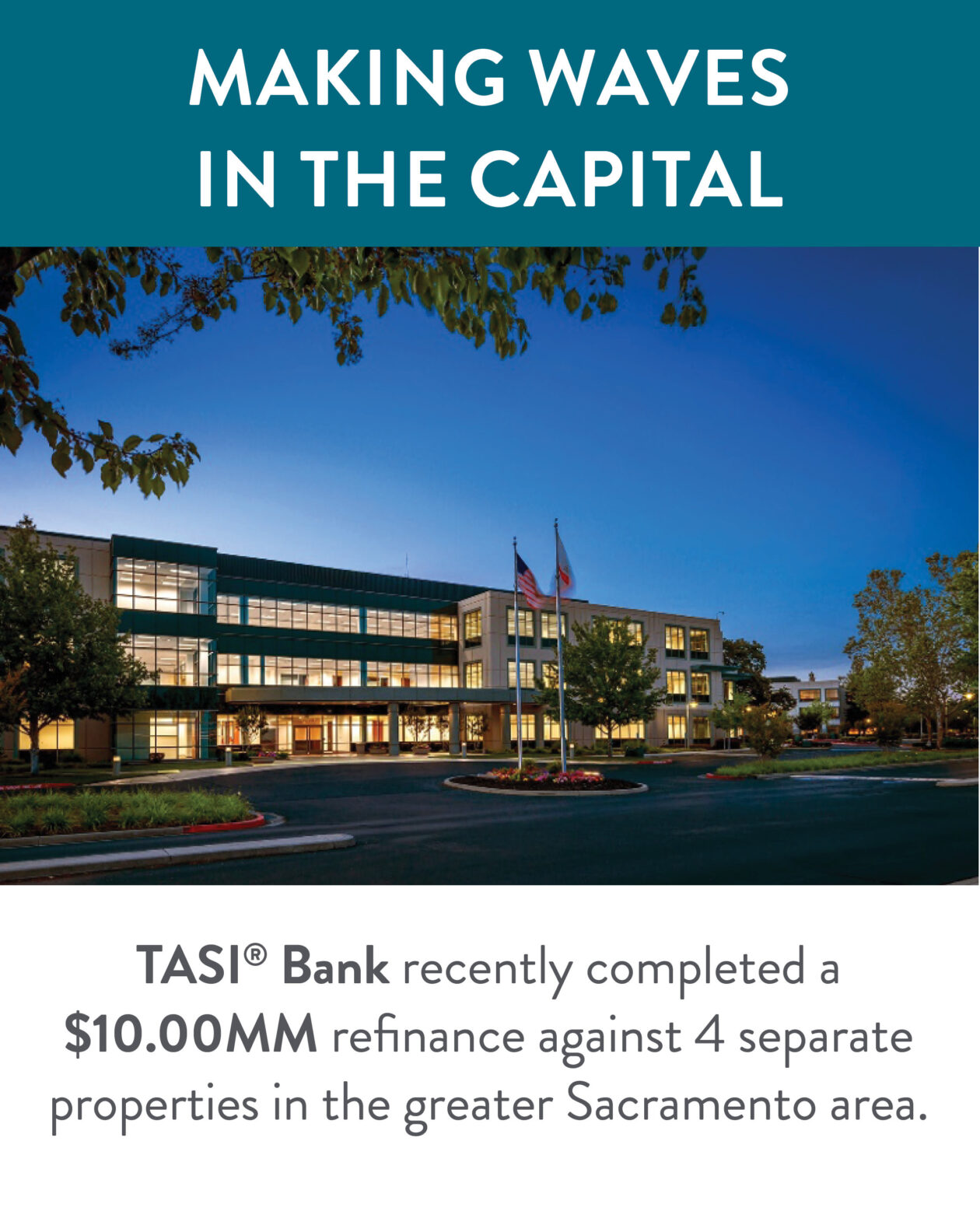

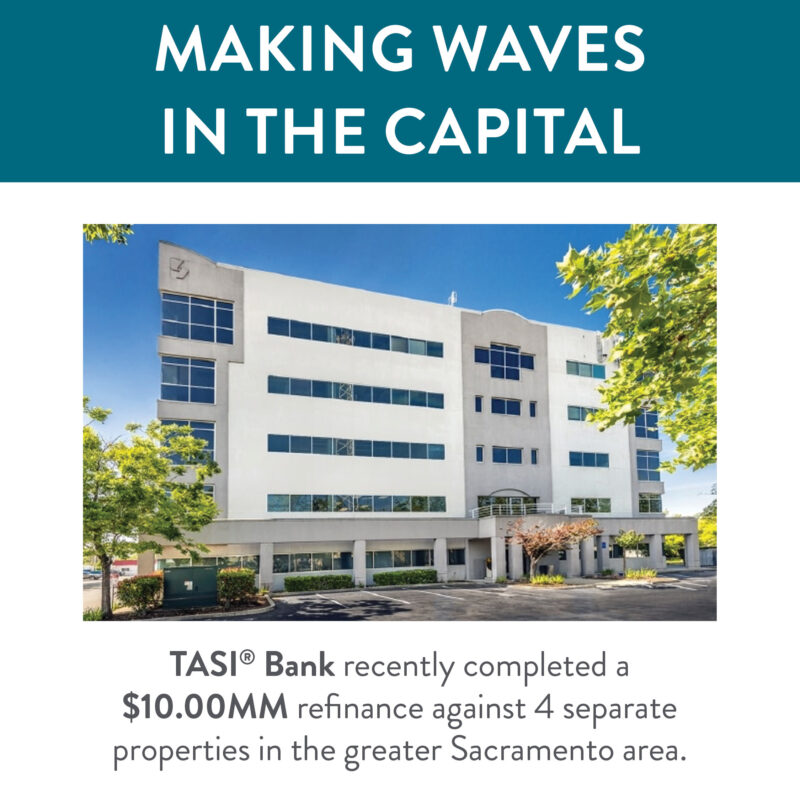

1.14.26 - Another Maverick Splash: Making Waves in the Capital

01.14.2026

$10.0MM Refinance | Greater Sacramento Area

- Client Profile

Client Type: Long-term TASI® Bank relationship

Asset Class: Office / Retail

Geography: Greater Sacramento Area

Portfolio Size: 4 properties

Total Square Footage: 300,000+ sq. ft.

- The Challenge

The client owned a diversified office and retail portfolio spread across multiple properties in the greater Sacramento market. While the assets were performing, the existing capital structure limited flexibility and constrained the client’s ability to proactively manage and stabilize the portfolio in a shifting economic environment.

The objective was clear:

- Refinance multiple assets under a cohesive strategy

- Improve liquidity and long-term stability

- Maintain operational continuity without disruption

- This required a lender capable of underwriting complexity — not just assets.

The Solution

TASI® Bank structured and completed a $10.0 million refinance across four separate properties, aligning the financing with the client’s long-term ownership strategy.

By approaching the portfolio holistically, rather than as isolated transactions, TASI® Bank delivered a solution that balanced disciplined underwriting with practical flexibility — ensuring the refinance supported both current performance and future planning.

Key elements of the solution included:

- Portfolio-level analysis across multiple properties

- A streamlined refinance process to minimize friction

- Terms designed to enhance capital access and stability

The Outcome

- The successful completion of the refinance provided the client with:

- Improved access to capital

- Enhanced portfolio stability

- Greater financial flexibility for long-term decision making

- With a stronger capital position in place, the client is now better equipped to manage, optimize, and sustain the portfolio through market cycles.

Why It Matters

In today’s commercial real estate environment, execution matters just as much as pricing.

This transaction reflects TASI® Bank’s relationship-driven approach to commercial lending — one that prioritizes:

Long-term partnerships over one-off deals

Market knowledge paired with disciplined execution

Solutions built for durability, not just scale

Sacramento remains a key Northern California market, and TASI® Bank continues to support clients who are committed to building resilient portfolios that serve both tenants and communities.

At a Glance

Transaction Type: Refinance

Total Loan Amount: $10.0MM

Properties: 4

Asset Type: Office / Retail

Market: Greater Sacramento Area